Please Note : The only finance option we can currently offer to ROI Customers is through Paypal

Buy now, pay later with PayPal Credit

PayPal Credit is like a credit card without the plastic. And with 0% interest for 4 months on all purchases of £99.00 or more, it’s the perfect way to spread the cost of larger online purchases.*

A 0% interest offer you can use again and again.

Our 0% interest offer is better than just an introductory offer. Simply spend over £99.00 and you get 0% interest for 4 months on that purchase. The great thing is you’ll automatically get 0% for 4 months every time you spend over £99.00. So, if you’re planning a weekend away or fancy splashing out on a new wardrobe, PayPal Credit is the perfect way to spread the cost of those larger purchases.

It’s quick and easy to apply for PayPal Credit – all you need to do is complete a short application form and we’ll give you a decision instantly. If approved and you accept, you’ll have a credit limit attached to your PayPal account to start using straightaway at thousands of online stores.

How our 0% works.

Spend £99.00 or more in one go with PayPal Credit.

Then automatically get 0% interest for 4 months on that purchase.*

Even better, you can use this offer again and again on every purchase over £99.00.

How does PayPal Credit work?

No card. No hassle. Just credit with plenty of benefits.

Instant Access

If approved, you can start shopping straightaway with PayPal Credit.

Offer never expires

0% interest for 4 months every single time you spend £99.00 or more in one go.*

Convenient way to shop

PayPal Credit is accepted at thousands of online stores.

On your side

We know how busy you can be so we’ll send you payment reminders.

Pay in Installments

Monthly instalment offers at selected merchants so you can spread the cost over longer periods.

In safe hands

Your details are never shared and PayPal Buyer Protection covers your eligible purchases.

Easy management

Manage your PayPal account anywhere – on your desktop, mobile or tablet.

Shop faster

Speed through checkout quicker and easier with just an email address and password.

Am I eligible to apply for PayPal Credit?

Before you apply, please make sure you:

Are a UK resident aged 18 years or older

Have a good credit history

Have not recently been declared bankrupt

Be employed and have an income greater than £7,500 per year

How do I pay with PayPal Credit?

Select Pay Later at the checkout to apply.

The application form takes minutes to complete. PayPal will then run a credit check and, if approved, you'll have a credit limit linked to your PayPal account as soon as you accept your Credit Agreement.

You can use the credit limit granted to pay for today's purchase and future purchases at thousands of online stores where PayPal is accepted, up to your credit limit

What happens if I cancel or return my order?

As soon as your cancellation/return has been accepted by us, the money will be refunded to your PayPal Credit account.

For more information, visit PayPal's FAQ Page

Pay Everyday, Everwhere

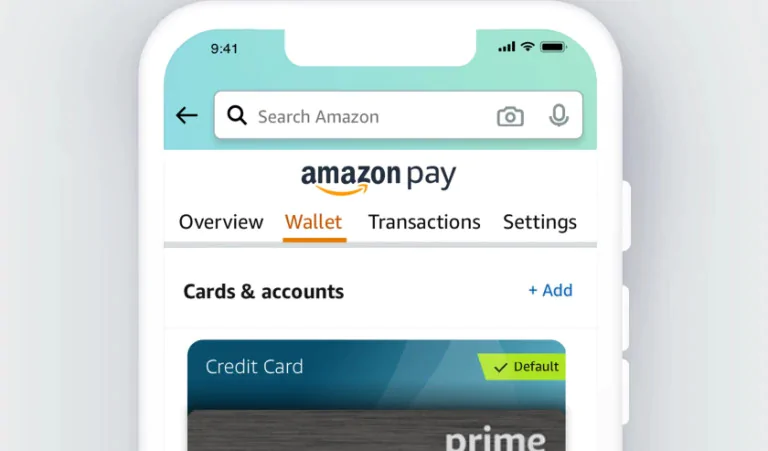

What is Amazon Pay?

With Amazon Pay, you can enjoy the convenience and security of Amazon wherever you shop. Amazon Pay offers a simple way to check out from your favorite online stores, and manage your payment methods on Amazon.com.

The Smart way to pay

Get the most out of your Amazon account

How does Amazon Pay work?

If you have an Amazon account, you are ready to start using Amazon Pay wherever you see the Amazon Pay button. Simply click the button when checking out to use the information already stored in your Amazon account. You don’t need to create a new account or remember old passwords. As a result, you can check out faster with the security and reliability that Amazon offers.

Is Amazon Pay part of Amazon?

Yes, it is. As an Amazon account holder, you are eligible to enjoy the benefits of Amazon Pay everywhere you see it, at no cost to you. That means your eligible purchases are protected by our A-to-z Guarantee, and all your transactions are safe and secure.

Shopper Benefits

Smooth shopping ahead

The faster way to pay

Breeze through checkout using the payment and address information stored in your Amazon account.

Pay every day, everywhere

An easy way to manage your payments on Amazon.co.uk and check out at your favourite sites.

Shop worry-free

Amazon Pay’s checkout is secure, and your eligible purchases are also protected by our A-to-z Guarantee.**

For Further Information -

Click Here